Washington State Employment Security Wage Base

Each year the OEWS unit compiles occupational employment and wage estimates for Washington state. King county washington minimum wage.

How Unemployment Benefits Are Calculated By State Bench Accounting

The change to the taxable wage base takes effect Jan.

Washington state employment security wage base. Experience tax currently capped at 54 RCW 5029025 Annual tax calculation based on the ratio of benefit claims of former employees charged to the employer and taxable wages reported by the employer over the preceding four fiscal years. Starting January 1 2022 ESD will assess each Washington employee a 058 premium assessment based on their wages. However you still have to factor in Unemployment Insurance and Workers Compensation Tax.

As you are well aware there are no state or local income taxes in Washington. Sick leave under a nonqualified plan per RCW 5004330 and WAC 192-310-0402. State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer paysSome states apply various formulas to determine the taxable wage base others use a percentage of the states average annual wage and many simply follow the FUTA wage base.

Average salary for Washington State Employment Security Department Tax And Wage Analyst in Seattle. Download Data InformationFAQ Personnel Included Specific Government Positions. This taxable wage base is 56500 in 2021 increasing from 52700 in 2020.

The employer must collect this premium assessment through a payroll deduction and remit the proceeds to ESD. The Departments unemployment tax rates for 2021 are expected to be finalized in December. This federal-state cooperative program produces employment and wage estimates annually for nearly 800 occupations.

For 2021 the wage base is 56500. Get the latest information and learn about other resources that may be available to you at Washington States COVID-19 website. Paid Family and Medical Leave is a new benefit for Washington workers.

Determine the states annual wage base. Tips reported by the employee. Department of Labor Bureau of Labor Statistics BLS.

Based on 1 salaries posted anonymously by Washington State Employment Security Department Tax And Wage Analyst employees in Seattle. Its here for you when a serious health condition prevents you from working or when you need time to care for a family member bond with a new child or spend time with a family member preparing for military service overseas. For 2021 the wage base is 142800 meaning the maximum contribution is 885360 142800 X 62.

You may already have access. Washington State Unemployment Insurance varies each year. The rate may be adjusted every two years but cannot be greater than 058.

Salaries shown are the latest final data available from the Office of Financial Management. The Washington Department of Employment Security announced today that the unemployment taxable wage base is set to rise to 56500 in 2021 up from 52700 in 2020. When an employee earns above this threshold stop withholding and paying the tax.

Data for the University of Washington are being updated. The taxable wage base is the maximum amount on which you must pay taxes for each employee. The rate is calculated each year based on average wages in Washington.

Non-cash payments such as meals and lodging. State Unemployment Taxable Wage Bases APS Payroll. SecureAccess Washington allows Internet access to multiple government.

As of 2011 Washingtons annual wage limit is 37300 you pay unemployment tax up to this amount of wages paid to each employee for the year. The Washington Employment Security Department announced that due to a 55 increase in the average annual wage for 2018 the state unemployment insurance SUI taxable wage base will increase to 52700 for calendar year 2020 up from 49800 for 2019. Occupational employment and wage statistics OEWS OEWS is a program of the US.

Wages do not include jury-duty pay. SecureAccess Washington SAW is the protected sign-on service for much of Washington state government. When paid vacation or holidays earnings are reportable.

Check to see if you have a SAW account. Employment Employment RSE Employment per 1000 jobs Location quotient Median hourly wage Mean hourly wage Annual mean wage Mean wage RSE. The average Washington State Employment Security Department salary ranges from approximately 61637 per year for an Employment Specialist to 99092 per year for an Information Technology Specialist III.

The amount each employee was paid for working whether paid as a fixed salary hourly pay or overtime. Your rate depends on the number of former employees who have drawn benefits on your account and the size of your payroll. The Social Security wage base is subject to change annually.

Supreme Capital Group Map State Map Letter L Crafts

Suta State Unemployment Taxable Wage Bases Aps Payroll

Employer Costs For Employee Compensation For The Regions March 2021 Southwest Information Office U S Bureau Of Labor Statistics

Crivelli Ernesto Ruud Aloysius De Mooij And Michael Keen 2016 Base Erosion Profit Shifting And Developing Countr Developing Country Development Erosion

Chinese Visa Application Example Chinese Visa Chinese Name Application

Esdwagov Calculate Your Benefit

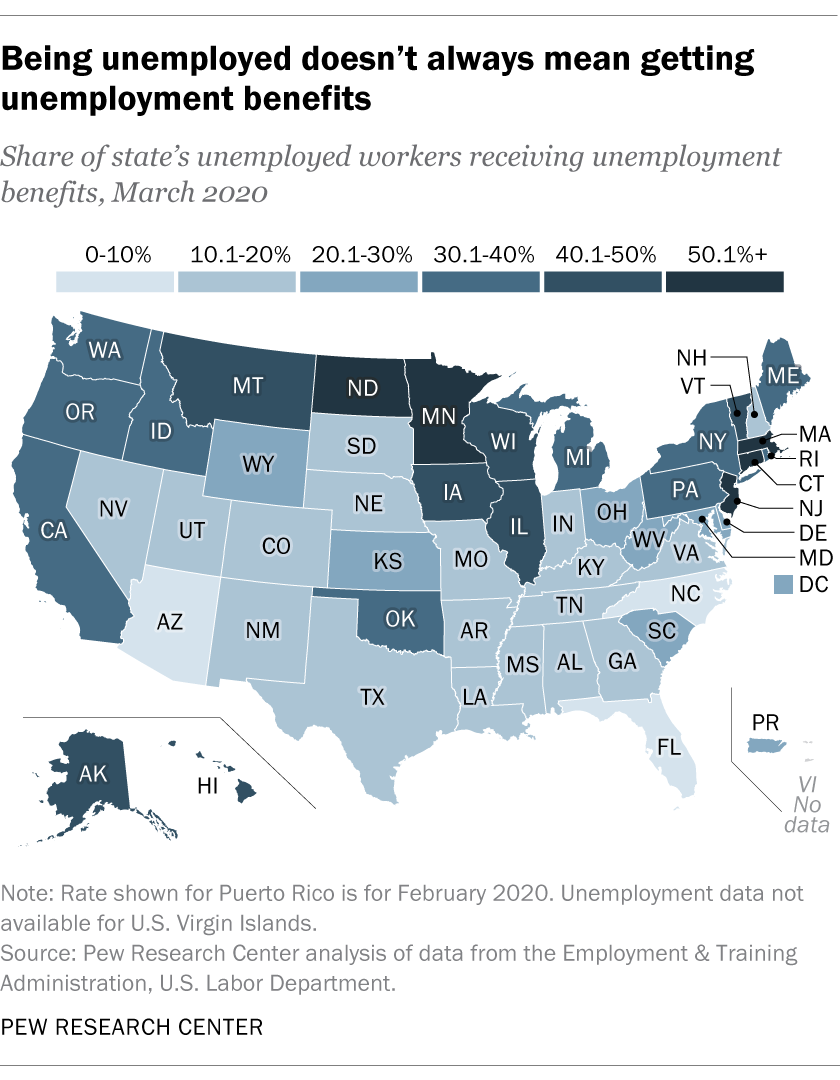

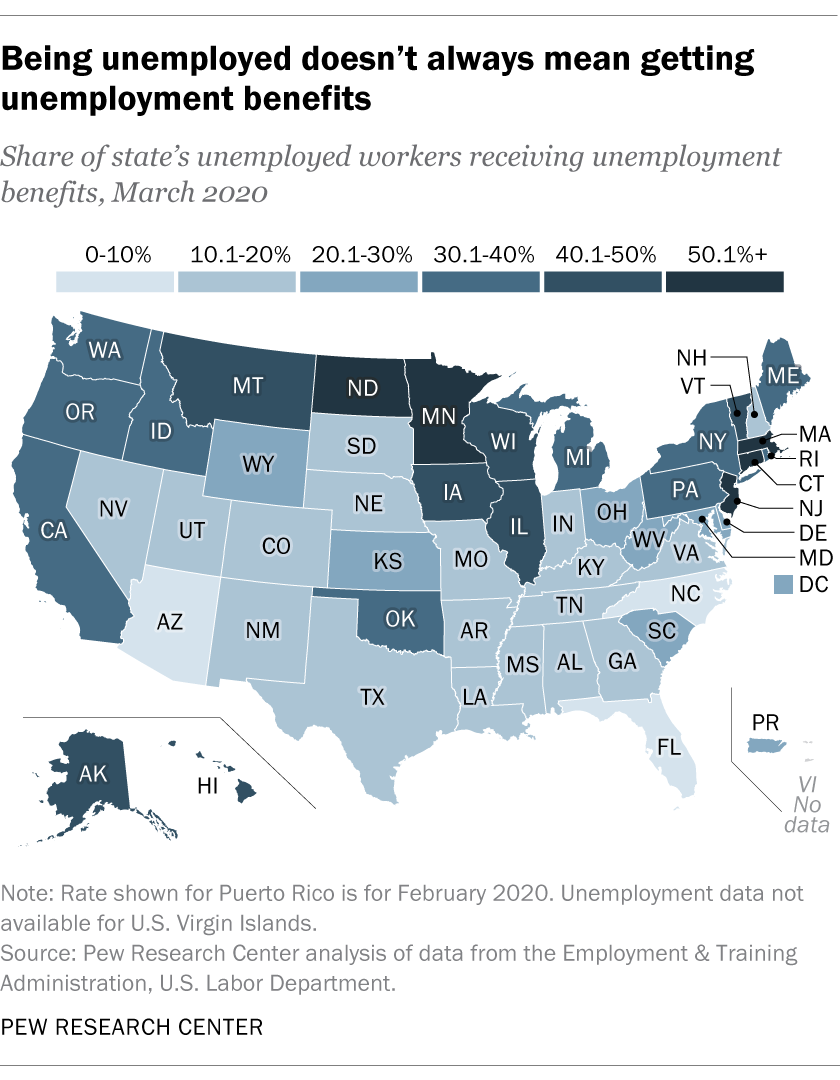

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

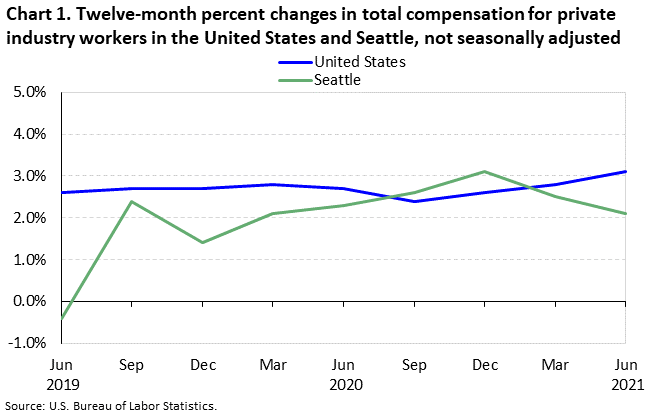

Changing Compensation Costs In The Seattle Metropolitan Area June 2021 Western Information Office U S Bureau Of Labor Statistics

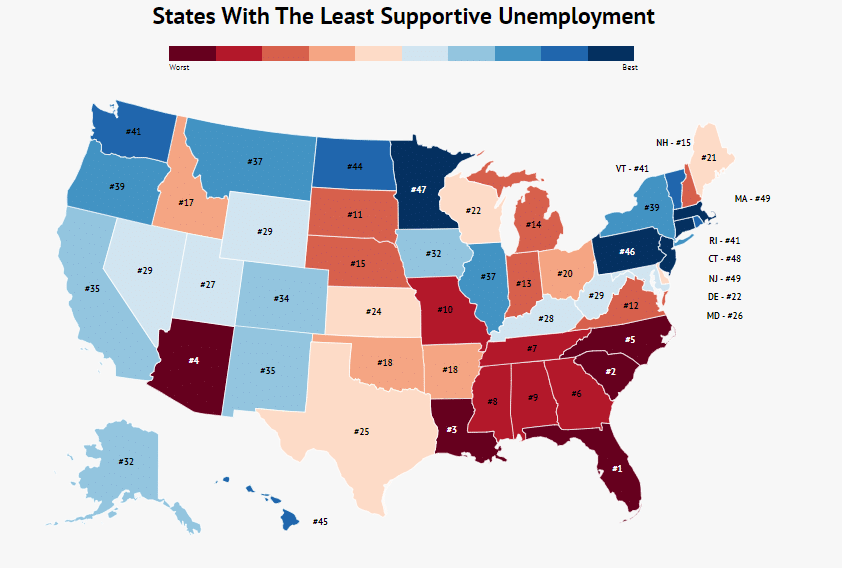

Here Are The States With The Least Supportive Unemployment Systems Zippia

Credit Report Template Free Printable Documents Equifax Credit Report Report Template Check Credit Score

Comcast Bill Sample Bill Template Comcast Play Money

Sui Sit Employment Taxes Explained Emptech Com

Esdwagov Calculate Your Benefit

Marriage America S Greatest Weapon Against Child Poverty Poverty Children Poverty Good Parenting

Pin On Example Cover Letter Writing Template

Social Security Wage Base For 2019 Announced

Dimorphodon Prehistoric Creatures Megafauna Prehistoric

Heating Cooling Technician Career Path Career Path Career Resources Career Information

Post a Comment for "Washington State Employment Security Wage Base"